Prepayment

Overview

A prepayment is a type of invoice you enter for an advance payment (deposit) to a supplier or an employee. For example, you may need to pay a deposit on a lease, or you may need to pay an employee an advance for travel expenses. Creating a prepayment is very similar to creating a regular invoice. Use the Prepayment Status report to review unapplied payments or unpaid or partially paid invoices for suppliers/employees.

Pre-requisites

1. Prepayment account at the Supplier Site has been setup.

2. Default prepayment payment term has been setup.

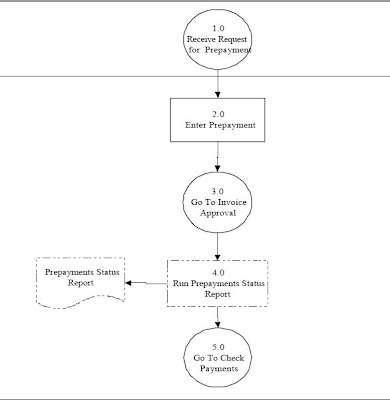

Process Flowchart

(For Clear View of the Image double click on it)

Process Steps

Step 1.0 Receive Request for Prepayment

Receive request in writing or electronically for a prepayment.

Prepayment is a type of invoice you enter to pay an advance payment for expenses to a supplier or employee. You can later apply the prepayment to one or more invoices or expense reports you receive from the supplier or employee to offset the amount paid to them.

A prepayment is a type of invoice you enter for an advance payment (deposit) to a supplier or an employee. For example, you may need to pay a deposit on a lease, or you may need to pay an employee an advance for travel expenses. Creating a prepayment is very similar to creating a regular invoice. Use the Prepayment Status report to review unapplied payments or unpaid or partially paid invoices for suppliers/employees.

Pre-requisites

1. Prepayment account at the Supplier Site has been setup.

2. Default prepayment payment term has been setup.

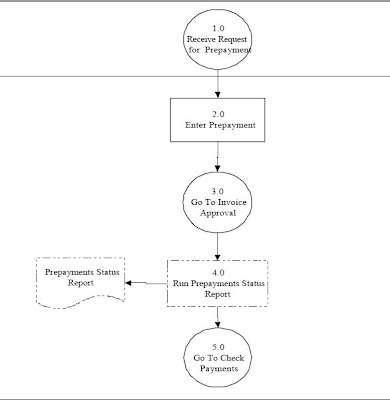

Process Flowchart

(For Clear View of the Image double click on it)

Process Steps

Step 1.0 Receive Request for Prepayment

Receive request in writing or electronically for a prepayment.

Prepayment is a type of invoice you enter to pay an advance payment for expenses to a supplier or employee. You can later apply the prepayment to one or more invoices or expense reports you receive from the supplier or employee to offset the amount paid to them.

If you want to apply a prepayment to one or more invoices or expense reports, you must first approve and pay the prepayments. You control when a prepayment is available by theSettlement Date you enter and by optionally applying a hold to the prepayment.

When you enter an invoice for a supplier for whom you have outstanding Temporary prepayments, Oracle Payables notifies you that you have prepayments available that you can optionally apply. You can also review the Prepayment Status Report to check the status of all prepayments in your system.

Step 2.0 Enter Pre-Payments

Find or Enter the Invoice with a ‘Type’ of Prepayment. There are also two types of Prepayments: Temporary and Permanent. Temporary can be applied against an invoice or it can be applied against an advance to an employee expense report. Permanent prepayments are created for expenses which are not invoiced for example a lease deposit. Permanent prepayments do not get applied against open invoices. You can however change the status from Permanent to Temporary in the Invoices window.

Create a Permanent prepayment for road tax and insurance premium. The system will create the following journal entries:

DR Prepaid Expense

CR Liability

DR Liability

CR Cash clearing/CashThe detail of expense for each item will be captured in General Ledger

Step 3.0 Go To Invoice Approval

Continue with invoice approval and resolve hold processing.

Step 4.0 Run Prepayments Status Report

Run this optional report to review unapplied prepayments and unpaid or partially paid invoices for vendors/employees. This report may also be used to compare invoices and prepayment for vendor/employees to determine if there are outstanding prepayments which can be applied against unpaid invoices.

Step 5.0 Go To Check Payments

Continue with the Check Payments process if applicable.

Comments

Post a Comment