How to Apply Credit Memo to invoice in Oracle Payables

In this below post, We will Create the Credit Memo in Oracle payables and then Apply this credit Memo in the Standard Payables Invoice.

These are the Below Steps We will perform to Apply Credit Memo in Oracle Payable.

1: Enter a Credit/Debit Memo in the Invoice Workbench. Enter a negative amount. Do not manually enter the distributions.

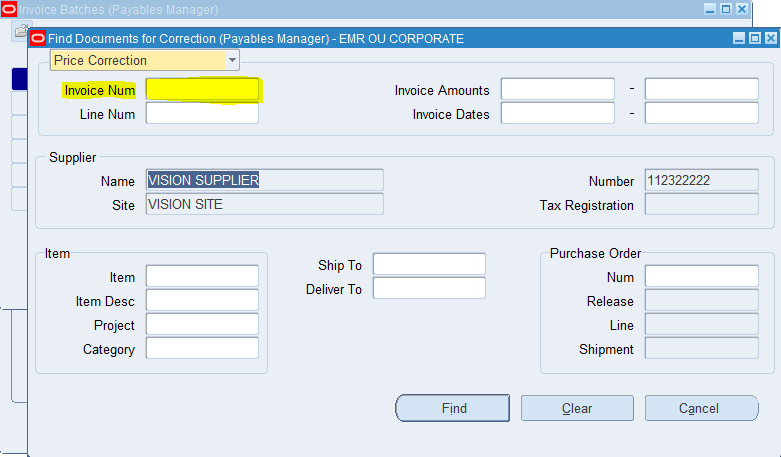

2: In the Match Action field scroll to Match Action field. Using drop down select Invoice.3: Click on the Correction button.

4: Enter search criteria for the invoice, in the Find Documents for Correction window. Click on the Find button.

Payables navigates to the Invoice Corrections window.

To see more information about an invoice, you can select it and click on the Invoice Overview button.

5: Select the invoice and enter a Credit Amount.

You can do the line level matching by clicking on Select Lines button.

Select each invoice line you want to match to and enter a Credit Amount.

6: Choose the Correct button to correct the invoice.

To review the new invoice lines, choose the lines tab from the Invoices window.

2: In the Match Action field scroll to Match Action field. Using drop down select Invoice.3: Click on the Correction button.

4: Enter search criteria for the invoice, in the Find Documents for Correction window. Click on the Find button.

Payables navigates to the Invoice Corrections window.

To see more information about an invoice, you can select it and click on the Invoice Overview button.

5: Select the invoice and enter a Credit Amount.

You can do the line level matching by clicking on Select Lines button.

Select each invoice line you want to match to and enter a Credit Amount.

6: Choose the Correct button to correct the invoice.

To review the new invoice lines, choose the lines tab from the Invoices window.

How to Apply Credit Memo to invoice in Oracle Payables

Comments

Post a Comment