Oracle Fusion FBDI : AR Auto Invoice Import

Steps to Import AR Invoices Through FBDI.

Step1:- Go to Oracle Repository to Download FBDI Data Templates

Step2:- Enter the Data in Data Template. Please be sure , your Transaction Batch Source Name should be created in the System

Step3:- Then click on the First tab of This Data Template and Click on 'Generate CSV File'

Step4:- This is the Zip file created from this Data Template.

Step5:- Go to Oracle Fusion and Then go to Navigator and Click on File Import and Export.

Step6:- Then Upload the ZIP file here below and select the UCM Account.

Step7:- Then go to Navigator again and click on Scheduled Processes.

Step8:- Then Run the Load Interface File Import as below.

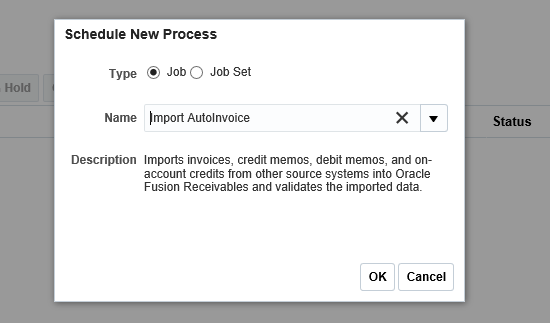

Step9:- Then Again click on Scheduled New Processes as below and run the second program.

Step10 :- Run the Second ESS job Import auto Invoice.

Steps to Import AR Invoices Through FBDI.

Step1:- Go to Oracle Repository to Download FBDI Data Templates

Step2:- Enter the Data in Data Template. Please be sure , your Transaction Batch Source Name should be created in the System

Step3:- Then click on the First tab of This Data Template and Click on 'Generate CSV File'

Step4:- This is the Zip file created from this Data Template.

Step5:- Go to Oracle Fusion and Then go to Navigator and Click on File Import and Export.

Step6:- Then Upload the ZIP file here below and select the UCM Account.

Step7:- Then go to Navigator again and click on Scheduled Processes.

Step8:- Then Run the Load Interface File Import as below.

Enter Parameters for this Program.

Step10 :- Run the Second ESS job Import auto Invoice.

Enter the Job Parameters and Select the BU and Source Accordingly as per the sheet.

Fusion Projects fbdi

ReplyDeleteUse Simplified Loader Project Tasks template provides user-friendly Excel sheets to load Project Tasks to Oracle Fusion. Use Simplified Loader sheets for data migration or BAU. Replace the complex FBDI process with a one-click upload using Simplified Loader. - <a

href="https://simplifiedloader.com/Catalogue/oracle_fusion_project_task_excel/simplifiedloader.com/Catalogue/oracle_fusion_project_task_excel</a